About Lion Insurance Company S.C. (LIC)

It gives us great pleasure to declare Lion Insurance Company’s keen desire to establish a mutually beneficial business relationship with your esteemed organization. Allow us therefore to reintroduce Lion Insurance Company (S.C.) and its services. To this end, we are pleased to hereby file the Company’s profile on the Ethiopian insurance industry for your records

Establishment

Lion Insurance Company (S.C) liable to its policyholders by transferring risk from an individual and business to the company. The Company was established in June 2007 by over 300 shareholders and has a broad public base. The company was registered at an ever higher initial paid-up capital of Birr 16 million and a subscribed capital of Birr 66.4 million which was one of the highest capitalized companies in the private insurance sector at formation.

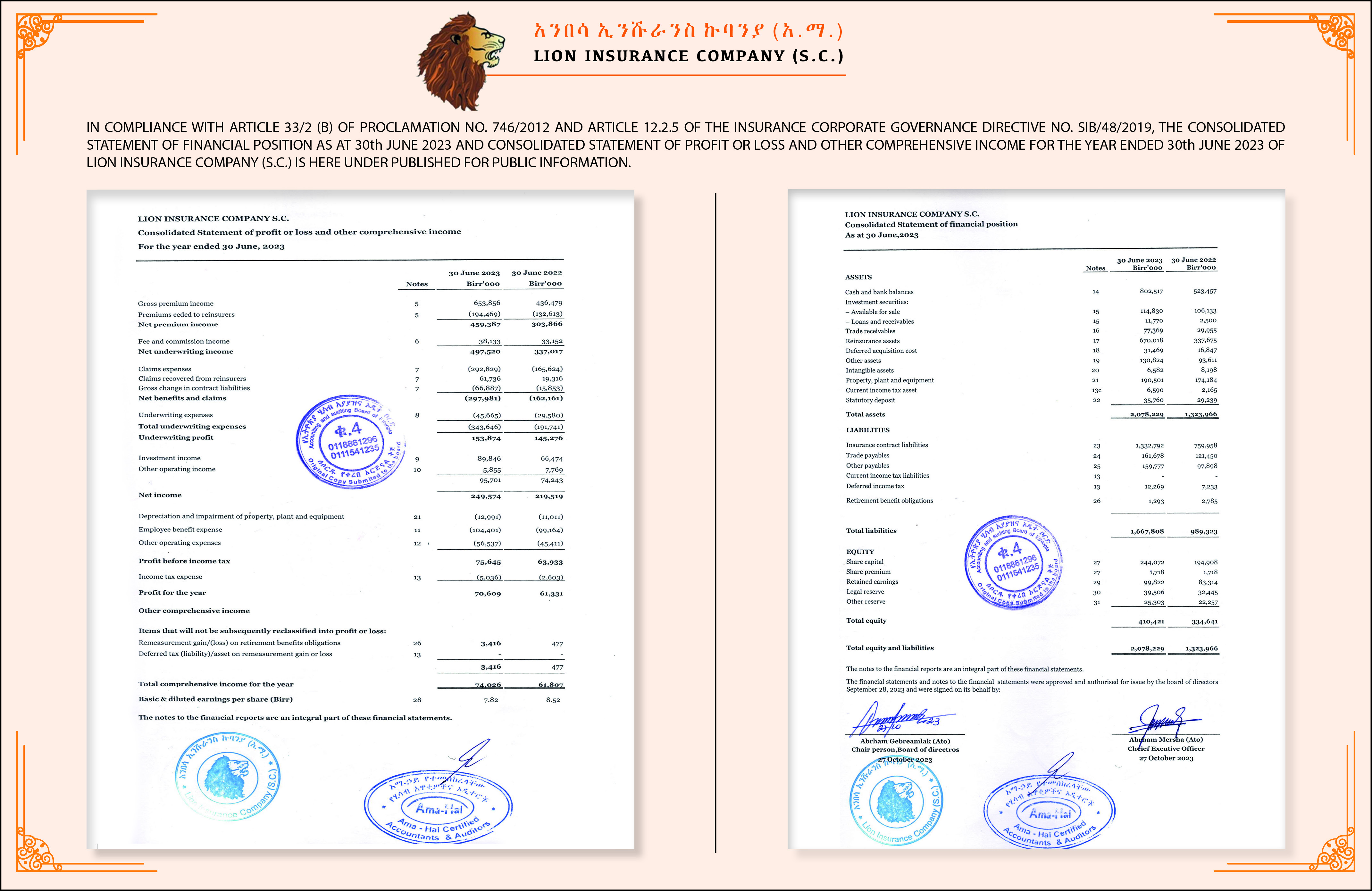

Company performance of 2024.

- Paid-up Capital Birr 401,813,882.43

- Total Assets Birr 2.6 Billion.

- Total Equity Birr 114.6 Million

- Gross Written Premium (GWP) of ETB 1.2 Billion

- Gross Profit or Loss is Birr 158 Million

- Subscribed Capital Reached Birr 1.2 Billion

The Company has acquired its own recovery yard area 7200 m2 at Akaki/Kality Sub City near Midroc Terminal and also owns a G+7 & G+6 building for its Head Quarter built on 1000 m2 area which is found on the street of Haile G/Sellasie Avenue, Lion Insurance Building.

Lion Insurance Company (S.C.) has been licensed to transact all life and non-life insurance products. Currently, the company is providing a full range of non-life products and life Assurance products.

Organization & Management

Lion Insurance Company (S.C.) is organized in such a way that it would easily to provide an efficient service to its customers. It is characterized by a flat organization structure with all units having broad authorities and thus customers’ cases shall be resolved expeditiously. The Board of Directors is the highest management body of the Company (S.C.). The Board is composed of renowned entrepreneurs and professionals who are highly dedicated to employ their expertise and experience to the Company’s growth and development.

The Executive Management as well represents a team of qualified and experienced professionals and practitioners in the insurance industry who tirelessly work towards the achievement of the Company’s objectives and to the satisfaction of its customers.

The manpower status Lion Insurance Company has total employee of 444 where 59% were core staffs and the remaining 41% were support staffs as well as 36% were males and 64% were females (May, 2024).

Service Philosophy

The Company’s service philosophy centers on indemnifying its customers with equitable compensation and timely service. To make efficient to claims service, decentralization has been made to the outlying branches: Mekelle, Adama, Gondar, Hawassa, Bahir Dar, D/Markos, Adwa and Shire with limit authority.

The Management of the Company is guided by adhering to applicable professional standards, ethics of conduct and good governance in implementing its goals and objectives. Furthermore, in Lion Insurance Company, as core stakeholders, clients are encouraged to participate to improve and maximizing our service Excellency.

Company Statement

A company statement is a brief description of a company’s values, mission, and overarching goals. It is often used to communicate the essence of the organization to employees, stakeholders, and the public.

Mission

Committed to serve our customers by offering quality and innovative insurance solutions, and capitalize shareholders’ wealth by diversifying investment, through the culture of client .centricity, by means of cutting age technology, the best professionals and discharging corporate social responsibility.

Core Value

- Protection

- Reliability

- Innovation

- Ongoing responses

- Responsibility

- Integrity

- Team work

- Yielding partnership

Business People

Branch

Customers

Hard Workers Employees

Our Major Clients

In the very short period of time the Company has been in operation, has managed to win the clientele of many big organizations among which are the following:

Transport

- NE-TSA P.L.C.

- Selam Bus P.L.C.

- Grand United Transport Cross Border Level 1,A Fright Transport Owners Association.

- Unity Freight Transport Owner Association P.L.C.

- Union Freight Transport Owner Association P.L.C.

- Yetebaberut transport Owner Association P.L.C

- Sebrina Transport Owner Association

- Wolele Transport Owner Association.

- Dalolle Transport

- Gehone Transport

Manufacturing Companies

- Arvind Life Style P.L.C.

- AL-ASR Textile Factory

- AL-Hassen Food Industries

- Al-Mehdi Group of Industries P.L.C.

- Avon Industries P.L.C.

- EAB Technology Solution P.L.C.

- ECC Energy

- Crown Textile P.L.C.

- Dubai Auto Gallery

Construction Companies

- SRBC Addis Engineering

- China Highway Group Limited

- China Railway 7th Group Ethiopian Branch

- Syno-Hydro Corporation

- CGCOC Overseas Construction Eth. Ltd(Road Bridge Project)

- Cross Land Construction PLC

- C.R.B.C.

- China Jiangaxi Corporation for International & Economic Technical Cooperation.

- AhmetAydeniz Construction Co- Bokra Construction P.L.C.

- Flower Construction P.L.C.

- Melcon Construction P.L.C.

- Zamra Construction

- Gallob Real Estate Dep’t P.L.C.

- United Construction P.L.C.

- Craft Construction P.L.C.

- Ayro Construction P.L.C.

- Zeta Construction P.L.C.

Trading

- Mohan P.L.C.

- Habesha Cenent S.C

- Getas International P.L.C.

- Gumsa Trading P.L.C.

- AGRISHER Trading P.L.C.

- Mulugeta Mekonnen

- A.G.T.A. P.L.C.

- Alba Business P.L.C.

- ALSAM P.L.C.

- Ambassador Garment & Trade P.L.C.

- Aqua Pure General Trading

- Associated Transit, Transport & Shipping P.L.C.

- AZ P.L.C.

- Baba International

- Basefa Trading P.L.C.

- Comet Trading House P.L.C.

- Country Trading P.L.C.

- Dag Trading P.L.C.

- Et-taz International Trading

- Eyasu Drug & Medical Supplies Import & Distributor

- Firdows General Import & Export Commission Agent Golagul Trading P.L.C.

- Tamirine International Trade

- Tekaf Trading P.L.C.

Hotels, NGOs, Educational Institutions & Financial Institutions

Hotels

- Harmony Hotel

- Holiday Hotel P.L.C.

- InterContinental Hotel

- Nigist Saba Hotel

- Kaleb Hotel

- Abyssinia Renaissance Hotel

- Radisson Blue Imperial Hotel

NGOs

- Africa Humanitarian Aid &Dev’t Agency.

- Care Ethiopia

- Tetra Tech (ARD)

- Cord Aid

- Tigray Development Association

- The Development Fund (FD)

- Mercy Care Ethiopia

Educational Institutions

- Admas University

- SRI SAI Consultants, Mgnt& Business

Financial Institutions

- work with all Banks